Introduction

On 18 February 2019 the government released a consultation on their proposals for how the new Plastic Packaging Tax would operate, with a planned launch date of April 2022.

The consultation considered a number of key questions, for example, which packaging should be in scope of the tax, how to assess recycled content, and which businesses will be liable for the tax. Government also sought views on the best design options.

Key information

The Plastic Packaging Tax consultation impacts all UK administrations - England, Wales, Scotland and Northern Ireland.

The deadline for consultation responses was 13 May 2019.

You can view the original Plastic Packaging Tax consultation document by clicking here which contains the questions referenced below.

The Ecosurety response

This article outlines our full consultation response which we openly shared ahead of the consultation deadline to encourage other people to use it for their own response, if they were aligned with our views. We hope this encouraged wider participation to the consultation to maximise representativity of each stakeholder group. Please note that we only responded to the questions that were relevant for us to feedback on.

Question 6: Do you agree with the government’s suggested approach to defining plastic in scope of the tax?

Yes. We believe that a primary raw material tax would be a more effective tax measure than the one proposed.

We agree that the UK should align with the EU definition and that any future UK EPR definition should also follow the same logic.

However, we believe that an exemption for compostable packaging that meets the EN 13432 standard should be considered for some food contact packaging. The UK government should not seek to increase recycled-content for certain food applications where contamination is highly likely to render the packaging unrecyclable.

Question 7: Do you agree with the government’s suggested approach to defining packaging and packaging materials in scope of the tax?

Yes. We agree that the definition should align with the current and future producer responsibility classification(s).

Question 8: Is the government’s approach to components of plastic packaging consistent with the way businesses operate and packaging is created?

Yes. We agree that the government should align with current and future producer responsibility definitions.

Question 9: Which of the above options for defining plastic packaging for composite material items do you think works better for the purposes of the tax?

Aligning with the Packaging Producer Responsibility regulations. We agree with the Government’s proposal of “predominant material by weight”, following the producer responsibility definition.

Question 10: Do you think alignment with the reformed Packaging Producer Responsibility regulations is important for the purposes of the tax?

Yes. We believe alignment with changes to producer responsibility is vital to avoid unintended consequences resulting from contradictory measures introduced by separate government departments. Please see example below of where different government department policy has caused an issue for recycling wood packaging material.

In 2011, BEIS introduced the Renewable Heat Incentive (RHI), which made cash payments to owners of biomass boilers that burned waste wood packaging. As a result, the amount of biomass boilers in operation increased. In 2018, Defra dramatically increased the wood packaging recycling target from 22% in 2017 to 38%. Consequentially, the government caused artificial competition between wood recyclers and biomass boiler operators for the same wood packaging material. The market was left confused over whether the government wanted wood to be burned for energy or recycled to create new wood products. This caused a dramatic increase in costs of wood packaging recycling for producers under the current producer responsibility regime. Wood recyclers had to pay higher prices for waste wood packaging to recycle as they were competing against a different government incentive that motivated biomass boiler operators to want to burn the same material.

In general, we feel alignment would be preferable to reduce the possibility of confusion and unintended consequences from the implementation of the tax.

The tax should not conflict with the proposed development of an ‘approved list’ of recyclable packaging, or any other method of setting modulated EPR fees, or deposit rates.

We feel that some producers may have concerns over what will be seen by some as multiple tax regimes for the same packaging items, or materials. These concerns may be even more acute for producers also liable for the costs of the proposed DRS.

Question 11: Do you agree with the government’s suggested approach to defining recycled content for the purposes of the tax?

Don’t know. We require further information regarding the pre-consumer material that would count towards the recycled content target. While we agree with the exclusion cited for pre-consumer material, we feel that it is only post-consumer waste that requires a demand-pull stimulus to increase recycled-content.

Question 12: Are there any environmental or technical reasons to consider excluding any particular ways of recycling plastic?

No. The definition of recycling should follow the EU Waste Framework Directive definition, as below.

“‘recycling’ means any recovery operation by which waste materials are reprocessed into products, materials or substances whether for the original or other purposes. It includes the reprocessing of organic material but does not include energy recovery and the reprocessing into materials that are to be used as fuels or for backfilling operations”

Therefore, any chemically recycled plastic feedstocks that are used in the creation of new packaging should count towards the recycled content target.

Question 13 Is there any way that the proposed approach to defining recycled content could encourage unintended consequences, such as wasteful manufacturing processes?

Don’t know. We require further information from the government on what pre-consumer material would count towards the target. We welcome the exclusions cited but are unsure in practice what pre-consumer stimulus the government is seeking.

Question 14: Do you agree with the government’s preferred approach of a single threshold, and why? If not, what alternative would be better, and what are the risks associated with this? Please explain your answer and provide any supporting information and evidence.

Don’t know. We agree with the government seeking to implement a simple, single threshold. However, we understand from our members that what is achievable differs per material.

In addition, material subject to EC282/2008 restrictions for food contact applications should be exempt.

Question 15: Assuming a single threshold, do you agree with a 30% threshold for recycled content and why?

No. The government should also consider alignment with the EU targets for recycled content. However, we do not have specific expertise to advise on the appropriate level for a threshold.

Question 16: Are there any products for which it would be very challenging to increase the level of recycled content, and why? If so, please outline the effect of a tax on production decisions and consumption of these items.

Yes. We are aware that increasing recycled content in certain food contact applications would be extremely challenging but do not have specific information as we are not a producer of packaging.

Question 17: Are there any products for which the use of recycled plastic is directly prohibited in packaging? If yes, please provide details on these products stating the relevant legislation and industry standards as well as the effect of a tax on production decisions and consumption of these items.

Yes. Food contact legislation EC282/2008 effectively limits recycled content to rHDPE and rPET for certain applications. Therefore, for other materials used in food contact it is effectively illegal to have recycled content. In this instance, an exemption must apply.

Question 18: What evidence is currently held by liable manufacturers and importers on the levels of recycled content in their plastic packaging and how it might be able to meet the requirements of identifying recycled content levels?

We are not a producer of packaging. However, we have observed the difficulties that producers have had with supplying recycled content information as part of the UK Plastics Pact. We believe defining and certifying recycled content will be extremely challenging.

Question 20: Do you agree with the government’s suggested approach of setting a flat rate per tonne of a plastic packaging product? Why?

Yes. We agree with the government’s proposal for consistency with packaging producer responsibility. However, we believe that a primary raw material tax would be a more effective tax measure than the one proposed.

Question 21: Do you agree with the proposed points at which domestic or imported products would be liable for the tax? If not, at what point in the supply chain do you think the tax point should be and why?

Yes – Option 2. We believe that a primary raw material tax would be a more effective tax measure than the one proposed.

If the tax proposed is applied for importers of un-filled packaging and UK manufacturers of packaging, currently classed as convertors this would be consistent. However, if you are looking to also apply this tax to importers of plastic raw materials then the tax could be paid twice. The importer of plastic raw material may not know what the intended use of the material will be.

We believe that the tax must also be applied to imported filled packaging, (i.e. packaged goods), to ensure that UK competitiveness is protected.

Question 25: Would you support extending joint and several liability for UK production and imports?

Yes. We would support extending joint and several liability, if this would align with other current UK tax regimes.

Question 27: Do you agree with the government’s initial proposal that the tax at import should only apply to unfilled packaging? If not, what would the effects be? What alternative would you prefer and how would it work?

No. The government’s proposal does not create a level playing field for UK manufacturers. The tax should apply to all filled by default as it is difficult to certify its recycled content, rather than being exempt for the same reason. It is highly likely that packaging operations will move out of the UK should the current proposed exemption apply.

Question 28: Do you agree with the government’s suggested approach for crediting exports?

No. The exporter is not always the person who has paid the tax, therefore the person paying the tax should be eligible to obtain a credit. This could be undertaken in a similar way to ‘third party export’ declarations as practised in the current packaging regulations.

Question 29: Do you foresee any difficulties in providing the appropriate records to demonstrate that packaging has been exported?

Yes. The party exporting the packaging, would be unlikely to provide the required level of documentation to the person who has paid the tax and wants to claim a credit due to the commercially sensitive nature of the records. Therefore, a simple system is required as referred to in Q28, a third-party export declaration.

Question 31: Would Option 1a, Option 1b or Option 2 best meet the government’s objective of excluding small operators from the tax whilst ensuring the tax has a strong environmental rationale?

Option 1b. This ensures that an operator must reach a reasonable size both financially and in terms of tonnage before they are eligible to pay the tax.

Question 32: What factors should the government consider when setting a threshold (either on volume or turnover) or a relief? Do you have any suggestions for appropriate levels? If so, please provide an explanation for why you believe this is appropriate.

The government should seek to align thresholds with reformed producer responsibility definitions.

Question 33: Would having a de minimis create any significant risks to the effectiveness of the tax at import (including, but not limited to, treatment of multiple imports from the same exporter/manufacturer/brand owner)? If yes, please provide evidence and suggest any additional legislative or operational countermeasures.

Don’t know

Question 40: Is our approach regarding assuring the accuracy of declared recycled content appropriate? If not, please share any other suggestions you may have.

No. It is not clear how the government expect the recycled content to be declared, however it seems to be inferred that the declaration would be ‘self-confirmed’ by some form of certification. Following discussions with a number of bodies we understand that there is no current test available to determine with any verifiable accuracy, the recycled content of plastic packaging. Therefore, we are unsure how a declaration could be challenged by the government.

Question 56: Unless already covered in your responses to other questions within this document, is there anything else you would like us to note about the impact of the tax, especially any potentially adverse impacts on groups with protected characteristics?

We are surprised that the government is looking to implement a Plastic Packaging Tax before other more meaningful measures are in place. We believe that the government should introduce changes to packaging producer responsibility and consistent household packaging collections before considering any tax changes.

Without these measures in place first, it is unlikely that there will be enough domestically reprocessed material to meet the government’s proposed 30% threshold. We believe UK manufacturers will either import plastic recyclate to meet the target in the short-term or, more likely given the proposal to exempt imports of filled packaging, move their packaging operations to outside of the UK.

The focus of the tax is too narrow as it is not just packaging applications that require a recycled content stimulus. Perhaps, given the problems associated with food contact packaging legislation, the government should put more focus on recycled materials being used in moulded products, like car bumpers. While we welcome the endeavour by government to tackle the difficult issue of creating demand for recycled content, the Plastic Packaging Tax proposal requires significant changes in order to drive the government’s desired outcomes.

Plastic Packaging Tax resources

The Plastic Packaging Tax went live on 1 April 2022. To help you understand your tax liabilities and obligations under the new tax, please read our guide The Plastic Packaging Tax essential guidance - what you need to do.

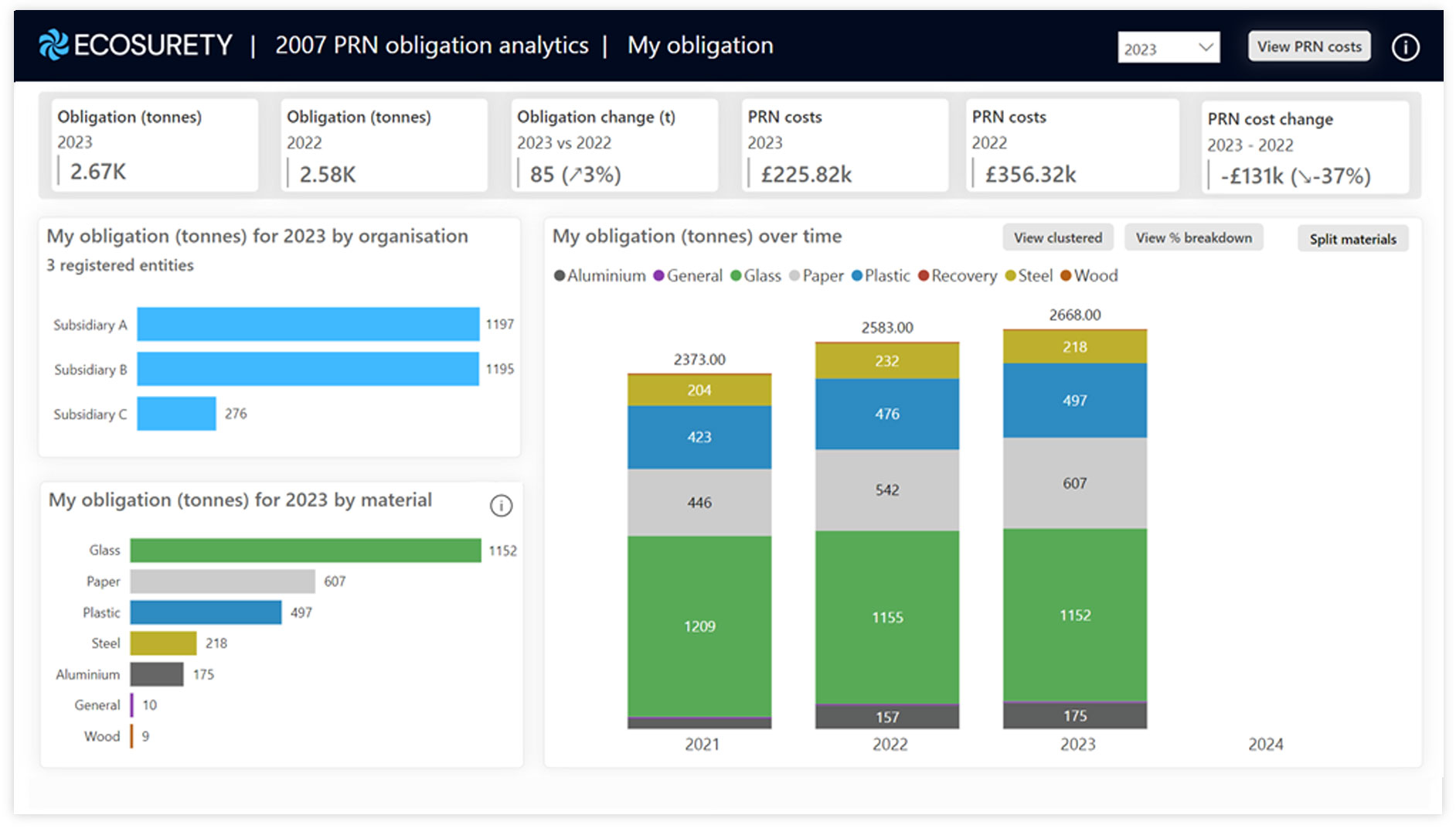

You can also find out more about our Plastic Packaging Tax data services, including interactive analytical dashboards to help you forecast your obligations and identify how to improve your packaging to reduce your tax liabilities.

Robbie Staniforth

Innovation and policy director

Having spent years building an intimate understanding of the industry’s policies and politics, Robbie uses this knowledge to help shape new legislation and oversees Ecosurety’s growing portfolio of cross-industry innovation projects .